Non-Formulary Drugs: What They Are and Why They Matter

When your doctor prescribes a medication that your insurance doesn't cover, a drug not included in your health plan’s approved list. Also known as non-formulary medications, these are often more expensive or have cheaper, equally effective alternatives on the formulary list.

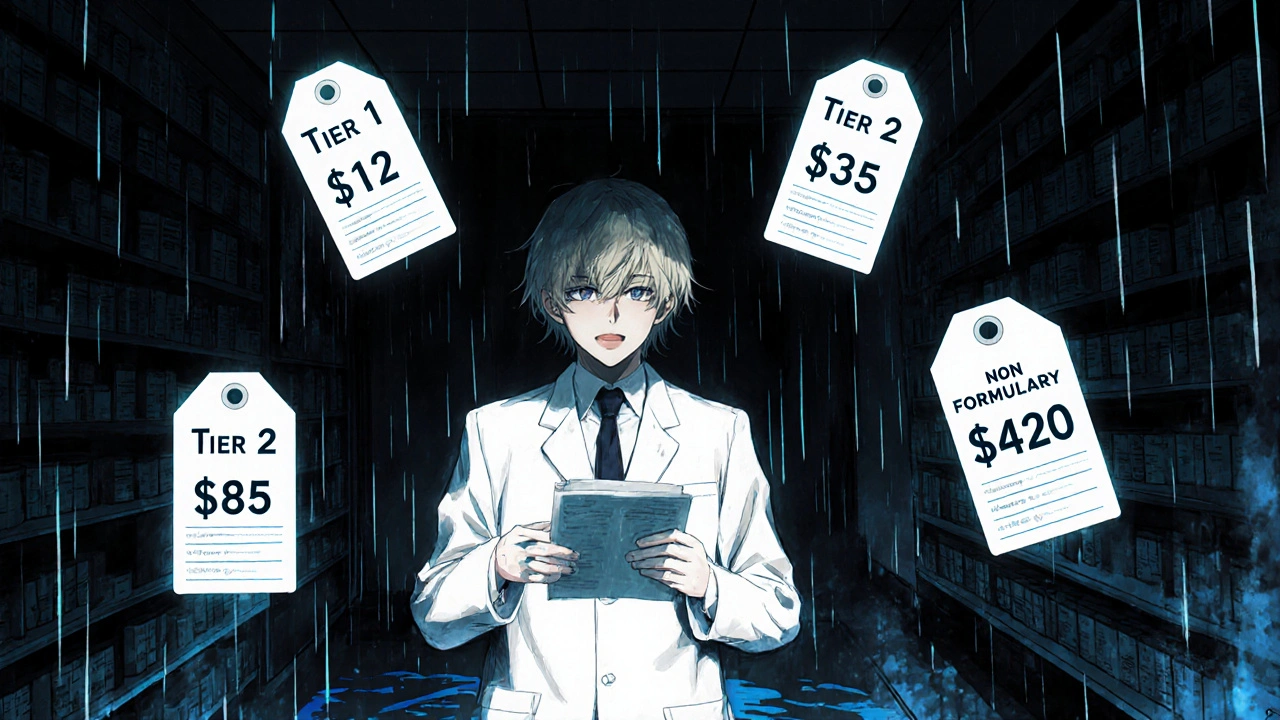

Most insurance companies create a formulary list—a curated selection of drugs they agree to pay for based on cost, safety, and proven results. If a drug isn’t on that list, it’s labeled non-formulary. That doesn’t mean it’s unsafe or ineffective. It might be newer, brand-name only, or used for rare conditions. But because it’s pricier, insurers push patients toward cheaper options first. For example, if a generic version of a drug works just as well, your plan will likely require you to try that before approving the brand-name version.

Some non-formulary drugs are necessary when other treatments fail. Think of patients with complex conditions like transplant rejection, severe epilepsy, or rare autoimmune diseases. Drugs like cyclosporine or tacrolimus have narrow therapeutic windows—tiny changes in dosage can cause rejection or toxicity. Even if they’re non-formulary, doctors may fight for coverage because there’s no safe substitute. In these cases, the cost isn’t just a number—it’s a risk to life.

It’s not always about money. Sometimes, a drug is non-formulary because it’s been flagged for safety issues. The FDA might have issued a warning, or there’s not enough real-world data to prove long-term safety. That’s why you’ll see posts here about FDA stability testing, import inspections, and how generic drug approval works. These systems exist to protect you, but they also create gaps—like when a life-saving drug gets stuck in regulatory limbo.

If you’re stuck with a non-formulary drug, you’re not alone. Many people end up paying out-of-pocket, asking for prior authorization, or switching plans. Some pharmacies offer discount programs. Others help you appeal the decision. The posts below show real cases: how people managed high-risk meds like opioids, handled withdrawal from blood pressure drugs, or found alternatives to expensive brand-name treatments. You’ll find practical advice on saving money, understanding your insurance rules, and talking to your doctor without feeling dismissed.

Non-formulary drugs aren’t the enemy. They’re often the last resort. But knowing how the system works gives you power—whether you’re paying $500 a month for a pill or fighting to get it covered at all. What follows isn’t just a list of articles. It’s a toolkit for navigating the messy, expensive, and sometimes confusing world of prescription drugs when the system doesn’t have your back.

Insurance Formulary Tiers Explained: Tier 1, Tier 2, Tier 3, and Non-Formulary Drugs

Nov, 16 2025