Ever filled a prescription and been shocked by the price - even though your insurance said it was covered? You’re not alone. The reason? Your plan’s formulary tiers. These aren’t just jargon. They directly control how much you pay out of pocket for your meds. Understanding them can save you hundreds a year - or at least stop the surprises.

What Is a Formulary, Really?

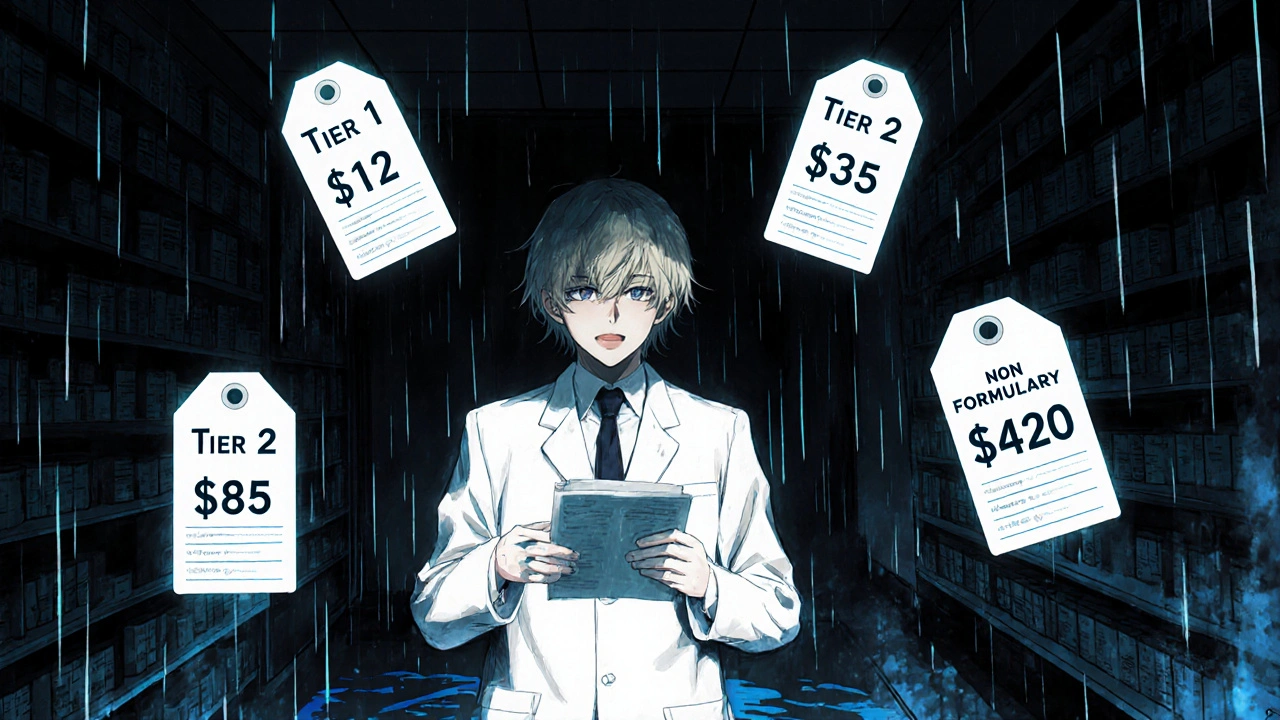

A formulary is simply the list of drugs your health plan agrees to cover. But it’s not just a simple list. It’s sorted into tiers - like levels in a video game - where each level means a different price for you. The goal? Encourage you to pick cheaper, equally effective drugs while still giving you access to what you need. Most plans use three or four tiers. Some go as high as five, especially for expensive specialty drugs. The key thing to remember: tier = price. Lower tier? Lower cost. Higher tier? Higher cost. And if a drug isn’t on the list at all? That’s non-formulary - and you’ll likely pay full price.Tier 1: The Cheap and Common

Tier 1 is where you want to be. This tier is almost always made up of generic drugs - the same active ingredients as brand names, but way cheaper. Think metformin for diabetes, lisinopril for high blood pressure, or atorvastatin for cholesterol. In commercial plans, your copay here is usually $0 to $15 for a 30-day supply. For Medicare Part D, it’s the lowest possible copayment. These are the drugs insurers love because they’ve been around for years, generics are plentiful, and manufacturers don’t need to charge a fortune. The catch? Not every generic is automatically in Tier 1. Some plans put certain generics in Tier 2 if they’re newer or if the manufacturer didn’t offer a good rebate. Always double-check your plan’s list.Tier 2: The Preferred Brands

Tier 2 is where you’ll find brand-name drugs that your plan has negotiated a good deal on. These aren’t generics, but your insurer thinks they’re worth covering at a reasonable price - often because they’re clinically preferred or have a strong rebate from the maker. You’ll pay more here - usually $20 to $40 for a 30-day supply in commercial plans. Medicare calls this the “medium copayment” tier. Examples might include popular brand-name versions of blood pressure or asthma meds that still have generic alternatives, but your doctor prefers this one for you. Here’s the twist: just because a drug is brand-name doesn’t mean it’s in Tier 2. If it’s more expensive and your plan has cheaper alternatives, it could jump to Tier 3. Your plan doesn’t care about the brand - it cares about cost and alternatives.Tier 3: The Expensive Brands

Tier 3 is the “non-preferred” zone. These are brand-name drugs without strong rebates, or where cheaper alternatives exist but your doctor insists on this one. This is where your bill starts to hurt. Copays here average $50 to $100 for a 30-day supply. Some plans charge coinsurance instead - say, 30% of the drug’s cost - which can mean $150+ if the drug is pricey. A lot of patients end up here accidentally. Maybe your doctor prescribed a drug you’ve always taken - but your new plan doesn’t cover it at a low tier. Suddenly, you’re paying triple what you expected. That’s why checking your formulary before filling a new script is critical.Tier 4 and 5: Specialty Drugs - And the Hidden Costs

If your plan has five tiers, Tier 4 and 5 are for specialty drugs. These are high-cost medications - often for conditions like rheumatoid arthritis, multiple sclerosis, cancer, or rare diseases. They’re usually injectables, infusions, or complex oral drugs that require special handling. Costs here aren’t fixed copays. They’re typically coinsurance - you pay a percentage of the total price. That could be 25%, 33%, or even 50%. For a drug that costs $10,000 a month, that’s $2,500 to $5,000 out of your pocket. Medicare Part D puts these in a separate “specialty tier,” but commercial plans often mix them into Tier 4 or 5. And here’s the kicker: many of these drugs aren’t covered at all unless you go through prior authorization or step therapy first. You might need to try two cheaper drugs before your plan will approve the one your doctor wants.Non-Formulary: The “Not Covered” Zone

If a drug isn’t on your plan’s formulary at all, it’s non-formulary. That means your insurance won’t pay anything - you’re on your own. This isn’t rare. It happens when:- The drug is new and hasn’t been reviewed yet

- The manufacturer didn’t negotiate a deal with your plan’s Pharmacy Benefit Manager (PBM)

- There’s a cheaper, clinically similar alternative available

Why Do Tiers Change - And Why Does It Feel Random?

Formularies aren’t set in stone. They’re updated quarterly. A drug you paid $15 for last month could jump to Tier 3 next month - no warning. Why? Because PBMs (like CVS Caremark or Express Scripts) negotiate rebates with drug makers. If a company stops offering a good discount, the plan moves the drug to a higher tier. Or, if a new generic hits the market, the brand-name version gets bumped up. A 2022 KFF survey found 43% of commercial plan members had at least one medication moved to a higher tier without clear notice. That’s not a glitch - it’s the system.

How to Avoid Cost Surprises

You can’t control the tiers - but you can control your response. Here’s how:- Check your plan’s formulary before you fill any new prescription. Most insurers have a drug lookup tool on their website.

- Ask your pharmacist: “Is this on formulary? What tier?” They see the list every day.

- Ask your doctor: “Is there a generic or Tier 1 alternative?” Many doctors don’t know the tier system - but they can switch if you ask.

- Use tools like GoodRx or SingleCare to compare cash prices. Sometimes paying cash is cheaper than your copay.

- If you’re hit with a high cost, file an exception. Your doctor can submit a letter saying the drug is medically necessary. You might get it moved to a lower tier.

What’s Changing in 2025?

The Inflation Reduction Act changed things. For Medicare Part D, insulin is now capped at $35 per month - no matter the tier. Starting in 2025, the out-of-pocket cap for all Part D drugs will be $2,000 a year. That means even Tier 5 drugs won’t cost you more than that annually. Commercial plans are watching closely. Some are starting to move toward “value-based” tiers - where drugs are grouped by how well they work, not just how much they cost. That’s still rare, but it’s coming.Bottom Line: Know Your Tier, Save Your Money

Insurance formulary tiers aren’t designed to confuse you - but they sure do. The truth? They’re a cost-control tool. The better you understand them, the less you’ll pay. Start small: next time you get a prescription, check the tier. Ask your pharmacist. Ask your doctor. You don’t need to memorize every drug - just know the pattern: lower tier = lower cost. And if you’re stuck with a high-cost drug? You have rights. You can appeal. You can switch. You don’t have to pay what they say - if you know how to push back.What does it mean if a drug is non-formulary?

If a drug is non-formulary, your health insurance plan doesn’t cover it at all. You’ll pay the full retail price out of pocket. This usually happens because the drug is new, too expensive, or there’s a cheaper alternative your plan prefers. You can ask your doctor to switch to a covered drug, or file a formulary exception request if there’s a medical reason you need it.

Can my insurance change my drug’s tier without telling me?

Yes. Insurance plans can change formulary tiers up to four times a year - and they’re not always required to notify you in advance. This is why it’s important to check your formulary before refilling any prescription, especially if you’ve had the same drug for months or years. A drug that was Tier 1 last year could be Tier 3 this year if the manufacturer stopped offering rebates.

Why is my generic drug in Tier 2?

Even generics can be in Tier 2 if your plan has negotiated better deals with brand-name versions of the same drug, or if the generic is newer and hasn’t been fully evaluated. Sometimes, the manufacturer of the generic didn’t offer a large enough rebate to get into Tier 1. It’s not about quality - it’s about cost negotiations between your insurer and drug companies.

How do I get a drug moved to a lower tier?

You can request a formulary exception. Your doctor needs to submit a letter explaining why the drug is medically necessary - for example, if lower-tier alternatives caused side effects or didn’t work. If approved, your plan may cover the drug at a lower cost. This process can take 7-10 days, but it’s often successful, especially with chronic conditions like diabetes or high blood pressure.

Are brand-name drugs always more expensive than generics?

Not always. Sometimes, due to rebates or discounts, a brand-name drug in Tier 2 might cost less than a generic in Tier 3. That’s why you should always check your plan’s specific pricing - don’t assume. Use your insurer’s drug cost tool or ask your pharmacist to compare prices before filling the script.

What’s the difference between a copay and coinsurance?

A copay is a fixed amount you pay - like $20 for a Tier 2 drug. Coinsurance is a percentage - like 30% of the drug’s total cost. Tier 4 and 5 drugs often use coinsurance, which can make your bill much higher if the drug is expensive. For example, a $5,000 specialty drug with 30% coinsurance costs you $1,500 - not a fixed $50.

Do Medicare and private insurance use the same tiers?

They’re similar but not identical. Medicare Part D plans must use at least four tiers: Tier 1 (lowest copay for generics), Tier 2 (preferred brands), Tier 3 (non-preferred brands), and a specialty tier for high-cost drugs. Private plans can be more flexible - some use three tiers, others use five. Private plans also have more freedom to exclude drugs entirely or use prior authorization rules.

Can I use GoodRx if my drug is on formulary?

Yes - and you should. Sometimes, a GoodRx coupon gives you a lower price than your insurance copay, even for Tier 1 drugs. Always compare. You can even use GoodRx for non-formulary drugs, which can save you hundreds. Just hand the coupon to your pharmacist instead of using your insurance.

kora ortiz

November 17, 2025 AT 17:12Just checked my formulary after reading this and found my metformin jumped to Tier 2. Called my pharmacy and used GoodRx-paid $7 instead of $22. This stuff matters. Stop letting them bury the rules.

Know your tier. Save your cash.

Jeremy Hernandez

November 19, 2025 AT 15:38PBMs are just middlemen who don’t make anything but profit. Your ‘formulary’ is a scam designed to make you beg for your own meds. The drug companies pay them off to push expensive stuff. You think this is healthcare? Nah. It’s a casino and you’re the sucker holding the losing hand.

And yeah, they change tiers without telling you. That’s not a glitch. That’s the business model.

Tarryne Rolle

November 19, 2025 AT 19:11It’s funny how we treat medicine like a commodity. We’ve outsourced compassion to spreadsheets and rebate negotiations. A drug isn’t just a molecule-it’s a person’s stability, dignity, sleep, sanity. But no, let’s tier it like a Netflix subscription. Tier 1 for the obedient, Tier 5 for the desperate.

Who decided that suffering should be priced in copays?

Kyle Swatt

November 21, 2025 AT 08:05I used to think insurance was supposed to protect me from bills. Then I got hit with a $900 bill for a Tier 3 drug I’d been on for five years. Turns out the manufacturer stopped paying the PBM’s bribes. That’s not healthcare. That’s corporate whiplash.

My doctor didn’t even know the tier changed. We’re all just guessing in the dark while they count cash.

But here’s the real kicker-when I filed an exception, they approved it in 4 days. So the system works… if you’re willing to fight. Most people just give up. And that’s how they win.

Deb McLachlin

November 22, 2025 AT 15:57Thank you for this comprehensive breakdown. I appreciate the clarity on the distinction between copay and coinsurance, particularly in relation to specialty tiers. As a Canadian resident, I find the U.S. formulary system both complex and concerning. The lack of transparency regarding tier changes is particularly troubling from a patient advocacy perspective. I will be sharing this with my colleagues in health policy.

It is imperative that patients are empowered with accessible tools and information to navigate these structures effectively.

saurabh lamba

November 23, 2025 AT 09:38bro why are we even talking about tiers

the whole system is rigged

you work your whole life and then they charge you $500 for a pill that costs $2 to make

why do we even have insurance if it doesn’t cover stuff

just give us free meds or shut up

Kiran Mandavkar

November 24, 2025 AT 05:36You people are naive. This isn’t about ‘saving money’-it’s about control. The PBM-pharma-industrial complex has turned healthcare into a feudal system. You think your ‘Tier 1’ generic is safe? It’s a placebo for the masses. The real drugs-the ones that work-are locked behind coinsurance walls. And you’re thanking them for letting you beg for your life.

Pathetic.

Eric Healy

November 25, 2025 AT 04:03my doc gave me a brand name and i thought i was getting a deal til i saw the tier 3 price

so i asked for the generic and they said it wasnt on formulary

so i went to costco and paid 12 bucks

why do we even have insurance if we pay more with it

smh

Shannon Hale

November 25, 2025 AT 11:36OH MY GOD I JUST REALIZED MY INSURANCE SWITCHED MY INSULIN TO TIER 4 LAST MONTH AND I DIDN’T EVEN NOTICE. I’VE BEEN PAYING $180 A MONTH FOR A DRUG THAT SHOULD COST $35 UNDER THE INFLATION REDUCTION ACT. I’M FILING AN EXCEPTION RIGHT NOW AND I’M TELLING EVERYONE. THIS IS A SCAM. THEY’RE STEALING FROM US WHILE WE’RE TOO TIRED TO FIGHT.

DOCTOR? TELL THEM I NEED IT. PHARMACY? TELL THEM I’M NOT PAYING THAT. I’M NOT DYING FOR A REBATE.

Holli Yancey

November 25, 2025 AT 12:07I just wanted to say thank you for writing this. I’ve been quietly struggling with my Tier 3 medication for a year and didn’t know I could appeal. I reached out to my doctor last week and we got my drug moved to Tier 2. It’s not perfect, but it’s a start.

It’s easy to feel powerless, but small actions-checking your formulary, asking questions, filing exceptions-they add up.

You’re not alone. And you’re not wrong to push back.