Insurance Formulary Tiers: How Your Drug Costs Are Decided

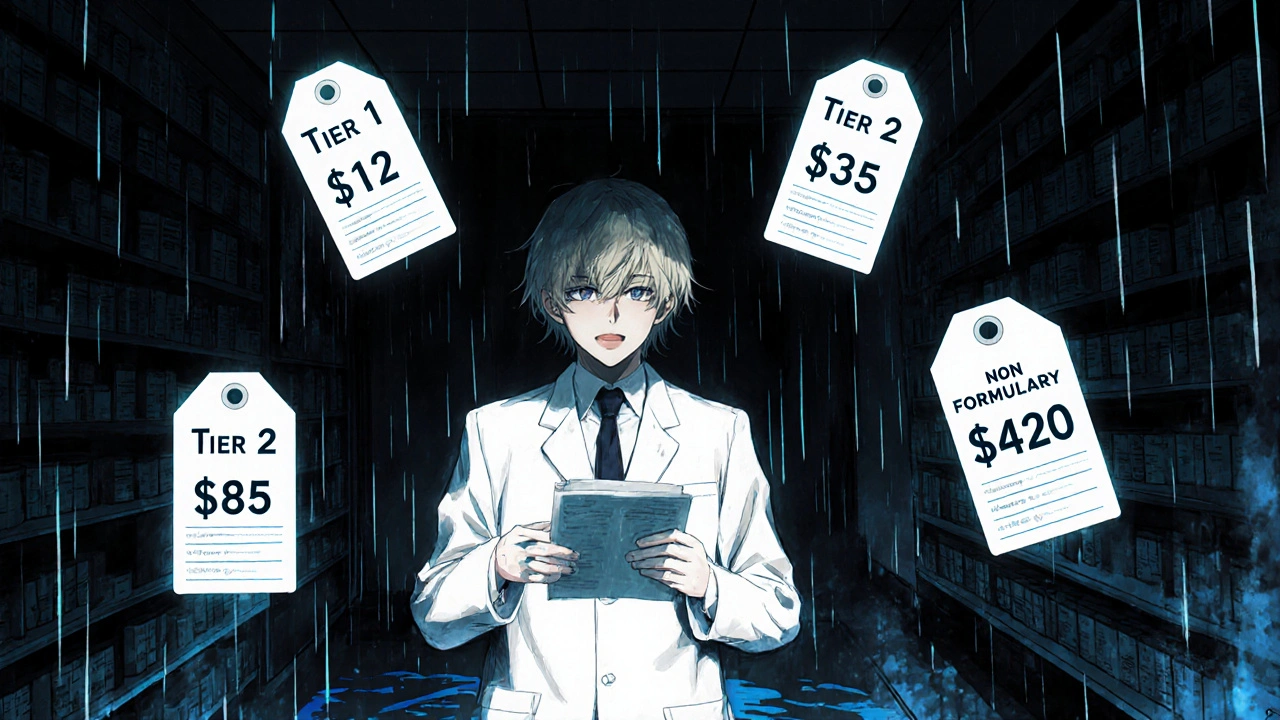

When you pick up a prescription, the price you pay isn’t just set by the drugmaker—it’s shaped by your insurance plan’s insurance formulary tiers, a system that groups medications into levels based on cost and clinical use. Also known as drug coverage tiers, this structure tells your pharmacy exactly how much you owe at the counter. It’s not random. Every tier has rules: lower tiers usually mean lower out-of-pocket costs, while higher tiers can cost hundreds more—even for the same medicine.

Behind every tier is a pharmacy benefit manager, a middleman hired by insurers to negotiate drug prices and build formularies. These companies decide which drugs make it onto the list, where they land, and whether generics are preferred over brand names. They don’t pick based on what’s best for you—they pick based on what’s cheapest for the plan. That’s why two people with the same condition might pay wildly different amounts for the same pill. Some plans push you toward cheaper alternatives, like generic versions of cyclosporine or sevelamer, even if your doctor prescribed the brand. Others require you to try a less expensive drug first before approving the one your doctor wants. This is called step therapy, and it’s built right into the formulary system.

Formulary tiers also change often. A drug might drop from Tier 3 to Tier 2 if a generic hits the market—or jump to Tier 4 if the manufacturer raises the price. That’s why your copay might suddenly go up without warning. You might not realize it, but your plan’s formulary is directly tied to the generic drug approval process, import inspections, and even stability testing requirements the FDA enforces. If a drug fails an inspection or gets pulled for safety reasons, it can vanish from your tier overnight.

And here’s the thing: not all formularies are the same. Medicare Part D plans, Medicaid, and private insurers each have their own rules. One plan might cover terazosin on Tier 1, while another puts it on Tier 3 because it’s considered less essential. That’s why comparing plans isn’t just about premiums—it’s about which drugs are covered, and at what cost. If you take multiple medications, even small changes in tier placement can add up to hundreds of dollars a year.

What you’ll find below are real, practical guides that help you navigate this system. You’ll learn how to check your plan’s formulary, how to appeal a denied drug, and why some medications—like immunosuppressants or phosphate binders—are treated differently because of how they work in your body. You’ll see how medication labels, prescription errors, and even electronic prescribing tie into this whole process. This isn’t theory. These are the tools real people use to fight high drug costs and get the meds they need without breaking the bank.

Insurance Formulary Tiers Explained: Tier 1, Tier 2, Tier 3, and Non-Formulary Drugs

Nov, 16 2025